Medicare Eligibility Requirements: Everything You Need to Know

Being able to finally enjoy the benefits of Medicare can be an exciting time. But let’s be honest. It can also seem pretty confusing. But we have some good news. First, it’s not as complicated as it may seem. Second, if your circumstances change over time or you’re unhappy with your chosen plan, there are opportunities to change Medicare plans every year.

But let’s not get ahead of ourselves. Let’s go over the biggest questions people have about Medicare eligibility requirements. And if you still have questions, know we are always available to answer them — no pressure or obligation.

When am I eligible for Medicare?

You become eligible to receive Medicare benefits when you are:

- Age 65 or older

- Younger than 65 but have a qualifying disability and have received Social Security for at least 24 months

- Any age with a diagnosis of end-stage renal disease or Amyotrophic Lateral Sclerosis (ALS)

Medicare Eligibility Calendar

Find out when you or your loved one will be eligible for Medicare.

| Birth Year | Eligibility Year |

|---|---|

1960 | 2025 |

1961 | 2026 |

1962 | 2027 |

1963 | 2028 |

1964 | 2029 |

1965 | 2030 |

I’m turning 65 soon. When can I enroll?

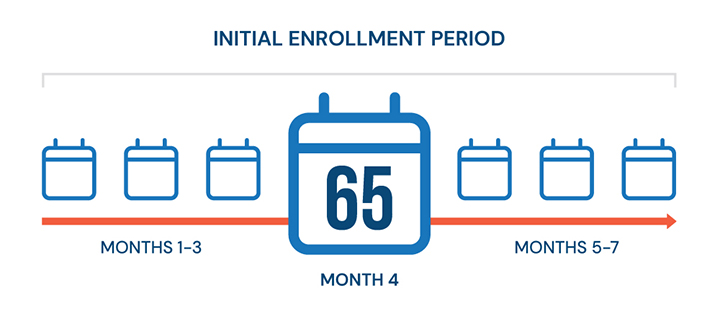

You can sign up for Original Medicare (Medicare Part A and/or Part B) up to three months before the month you turn 65, the month you turn 65, or up to three months after the month you turn 65. This seven-month period is called the Initial Enrollment Period (IEP). However, you don’t necessarily have to enroll in Medicare at this time (see below).

Also, if you are already receiving Social Security or Railroad Retirement Board benefits when you become eligible, you should automatically be enrolled in Medicare Part A and B.

Either way, once enrolled in Original Medicare, you can sign up for other coverage such as a Medicare Advantage plan (Part C), Prescription Drug plan (Part D) or a Medicare Supplement plan.

Do I have to enroll when I turn 65?

It depends. If you continue working past 65 or are on someone else’s health insurance, it’s likely you don't have to enroll in Medicare during the Initial Enrollment Period. But you might have to pay a penalty unless you have prescription drug coverage that’s similar in value to Medicare. Check with your employer’s benefits manager (or if you’re on someone else’s plan, check with the insurance provider).

Other times you can enroll are:

- Special Enrollment Period (SEP)

- Annual Enrollment Period (AEP)

- Medicare Advantage Open Enrollment Period

Learn more about the different Medicare enrollment periods and when you can change plans.

If I’m not retiring, is there anything

I have to do when I turn 65?

If you’re working past 65, you should probably still enroll in Medicare Part A since it’s free coverage as long as you or your spouse contributed to Social Security for 10+ years.

Enrolling in Part B depends on a few other factors:

If your employer has less than 20 employees, or you’re self-employed...

- You’ll need to confirm that you currently have creditable prescription drug coverage as good as the Medicare standard.

- If the answer to these questions is no, you’ll likely need to enroll in Part B.

- If enrolled in Medicare, your group health insurance will become secondary coverage, and Medicare will become the primary insurance.

If your company has 21 or more employees...

- You should be able to keep your current coverage and delay signing up for Part B.

- However, Medicare could be a better fit for your needs — and your wallet. Talk to one of our Medicare experts to determine your best option.

- Some employers may offer an Employer Group Medicare Plan: ask your employer’s benefits manager what options are available to you.

- If enrolled in Medicare, your group health insurance will be primary and Medicare will be secondary.

What if I'm working past 65?

Read transcripts

Like many people, you may choose to work past 65. If so, you may not need a Medicare plan right away, but there are still some things you need to do.

First, check to see if your employer offers coverage for those 65 and older. If you are on your spouse's plan, you should have them ask their employer. Even if your employer does offer a plan, you may still want to check it against a comparable Medicare plan to see which offers better benefits and savings.

But let's say you're going to stay on your employer's plan. You may still want to sign up for certain parts of Medicare to avoid penalties or gaps in coverage. Since Medicare Part A is free for most people who have worked at least 10 years, you should go on and enroll in it. Whether or not you need to enroll in Medicare Part B, when you turn 65, depends on the size of your company. If your employer has 20 or more employees, you can probably delay enrolling in Part B until you retire, but it's still a good idea to check with your employer and Social Security to find out what you need to do. You should also ask your employer about their plan's prescription drug coverage. If prescription drugs aren't covered, or if the coverage doesn't meet the Medicare standard, you'll need to enroll in a Part D Prescription Drug Plan, when you turn 65, to avoid paying penalties later.

When you are finally ready to retire, Medicare will be waiting for you, and you can choose the option that best fits your needs. Whatever you choose, be sure to enroll at least two months before you retire, as it takes a while to process your enrollment and you don't want to be left without coverage.

To learn more about your Medicare options, if you plan on working past 65, call our Medicare experts, at 1-800-678-2265.

What if I’m on someone else’s health plan?

You may have several options. It’s a good idea to talk with their employer’s benefits department to understand how Medicare may or may not work with your current coverage. You can also speak to one of our Medicare experts for more information.

Can I Apply for Medicare If I Lost My Job?

If you recently lost your full-time job and are no longer covered by a group health insurance plan, you can still apply for a Medicare plan. You should apply for Medicare Part A and Part B first, and then you can choose to enroll in a Part D prescription medication plan or Medicare supplemental policy. Or, you can select a Medicare Advantage plan that includes medication coverage instead.

Your timeline for applying for Medicare coverage depends on your age:

- If you’re already over age 65 and three months, you qualify for a SEP, which lasts until eight months after you lose your health coverage due to unemployment.

- If you’re within the three months before or after the month in which you turn 65, you qualify for the typical seven-month IEP.

How do I enroll in Medicare?

Ah, the big question. Fortunately, the answer is easy.

- Contact the Social Security office to enroll in Original Medicare (Parts A and B).

- Once enrolled in Original Medicare, you can enroll in additional plans for more coverage.

- These include a Medicare Advantage plan, a Medicare supplement plan, or a Part D prescription drug plan.

- To enroll in one of these plans, you’ll need to contact a private Medicare insurer such as Blue Cross Blue Shield of Massachusetts.

Learn about the different types of Medicare plans and what they cover.

Have more questions about Medicare Eligibility Requirements?

Talk to an Expert

Call one of our Medicare experts at 1-888-995-2583 (TTY: 711) anytime between 8:00a.m. and 8:00p.m. ET, Monday through Friday.

Attend a Medicare Seminar

Join us for an in-person or online seminar to learn more about Medicare and our plan options.

Request a Call

Set up a time to have a Medicare expert call you and discuss your questions and options.